French Stock Market

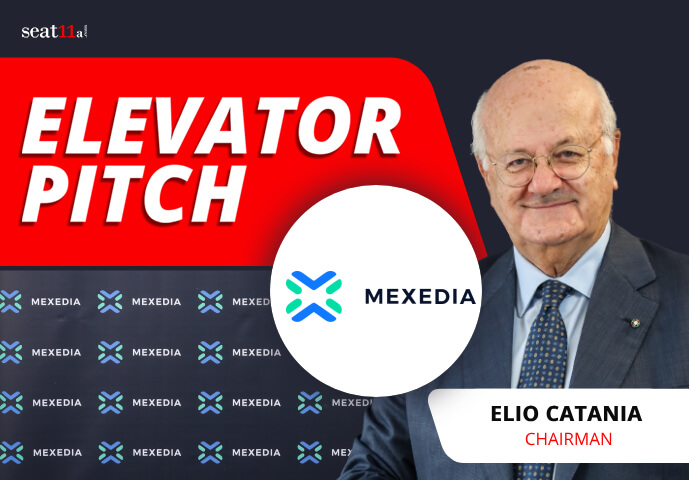

Company Briefings

Navigating the Landscape of French Stock Listed Firms

By loading the video, you agree to our Terms & Conditions,

our Privacy Policy and Vimeo's privacy policy.

France

France

Video Hub

At a Glance

The French stock market is a vibrant and integral part of the global financial landscape, led by its primary index, the CAC 40. This index, along with several others, provides a detailed picture of the French economy’s health and the performance of its corporate sector.

The CAC 40: A Global Barometer

The CAC 40, established in 1987, is the most notable French stock index, representing the 40 most significant stocks among the 100 largest market caps on the Euronext Paris. It features predominantly companies with a global presence, like Total, LVMH, and Airbus. This international exposure makes the CAC 40 sensitive to global market shifts, making it an essential indicator for investors looking for exposure to global economic trends through the lens of the French economy.

Unique Characteristics of the CAC 40

The CAC 40 is unique in its composition, reflecting a blend of domestic and international economic trends. It’s a mix of various industries, from luxury goods to aerospace, offering diversified exposure for investors. Historically, it has shown resilience and growth over the long term, with expected volatility during economic downturns, such as the 2008 financial crisis.

Broader French Market Indices

Beyond the CAC 40, several other indices offer a more expansive view of the French stock market:

- SBF 120: Including the top 120 stocks listed on Euronext Paris, this index extends beyond the CAC 40 to offer a broader market perspective.

- CAC Next 20: Focusing on the next 20 largest companies outside the CAC 40, this index highlights potential rising stars in the French market.

- CAC Mid 60: Targeting mid-cap companies, this index offers insights into smaller yet significant businesses in the French economy.

- CAC Small: Concentrating on small-cap companies, the CAC Small index is a window into early-stage and niche market businesses in France.

- Euronext Growth All-Share: This index captures the performance of smaller, high-growth companies and indicates the dynamic and emerging sectors of the French market.

Importance for Investors

The variety of indices in the French stock market allows investors to diversify their portfolios and tap into different segments of the economy. From the blue-chip companies of the CAC 40 to the high-growth potential of the Euronext Growth All-Share, these indices cater to varying investment strategies and risk appetites.

Performance in Different Market Conditions

The CAC 40 and its related indices perform well in bull markets, with sectors like luxury goods and industrials leading the charge. However, these indices, particularly the CAC 40 with its global exposure, can experience significant downturns in bear markets.

Global Comparison

Compared to major global indices like the S&P 500 or the DAX, the CAC 40 often exhibits similar trends but can show higher volatility due to its unique composition. The broader indices like the SBF 120 and CAC Mid 60 offer a more nuanced view, often aligning more closely with the domestic economic climate.

Conclusion on the French Stock Market

With the CAC 40 at the forefront, the French stock market is essential to the global financial system, offering investors a blend of stability and growth potential. The various French indices provide a comprehensive picture of the market, from large multinational corporations to dynamic, small-cap companies, making France an attractive market for a wide range of investment strategies.